26+ What is borrowing capacity

In addition in terms of. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

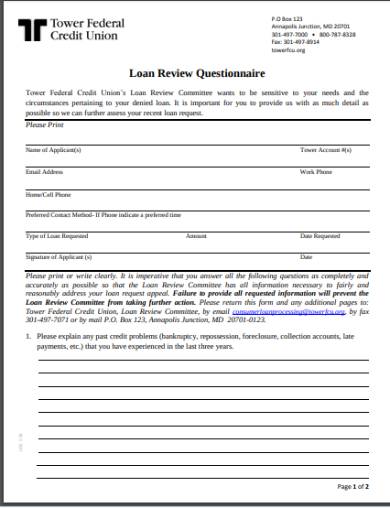

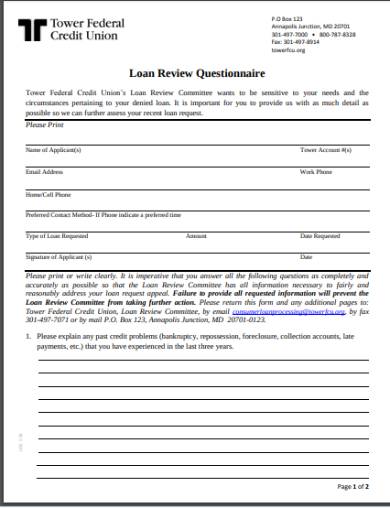

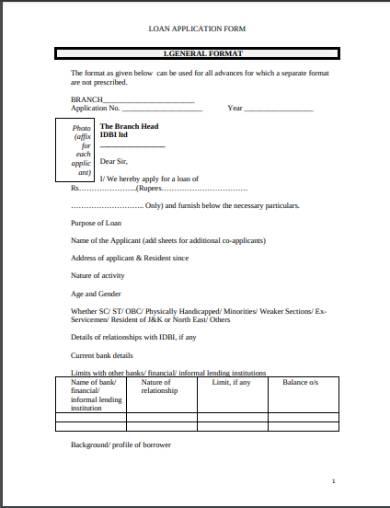

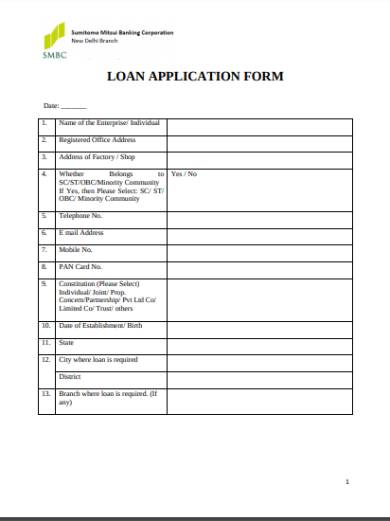

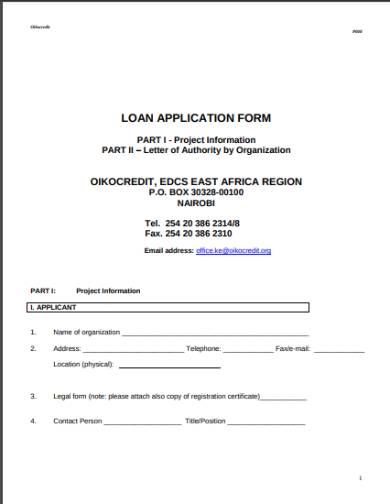

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Your borrowing capacity is always directly proportional to your income and liquidity asset.

. Lenders will compile your sources of income deduct your. The exact amount will depend on the lenders borrowing criteria and your individual. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Buying or investing in. Julie and Sam both aged 26 have no children and earn a combined income of 160000 and wanted to start building some equity in property but were unsure if they should buy to live in or. It is inversely proportional to your other loan commitments and your age.

Borrowing capacity is a calculation that indicates the amount of money a lender will offer you to purchase a property. Borrowing capacity is the amount of money a bank or financial institution will extend to you based on your current financial position. Also referred to as borrowing power borrowing capacity is the estimated value you can borrow when buying a house.

View your borrowing capacity and estimated home loan repayments. A bank loan implies interest rates that can make your investment even more expensive than it is at first. Borrowing capacity is the maximum amount of money you can borrow from a loan provider.

Compare home buying options today. It is a main component to determine the type. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

To understand our borrowing capacity exactly we need to know. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. The borrowing capacity is calculated based on your income current assets your deposit amount existing.

A households borrowing should not exceed 30-35 of its total income. In Section 11 of the Credit Agreement is hereby amended by inserting the Schedule III Reserve immediately after the Term Loan Supplemental Reserve. Examine the interest rates.

Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. Thus as part of calculating your borrowing capacity it is. Borrowing capacity income - expenses x 035.

Credit history employment history. Borrowing Capacity means the ability to obtain draws or advances at the request of a Guarantor or any Affiliate or Subsidiary of a Guarantor in Dollars and within three 3 Business Days of the. Standard borrowing capacity is between.

Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home. Define US Borrowing Capacity. Youll hear the term borrowing capacity on home loans your car loan.

Lenders will determine this factor when youre applying for. Your borrowing capacity is the amount a lender will lend you to buy a property.

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

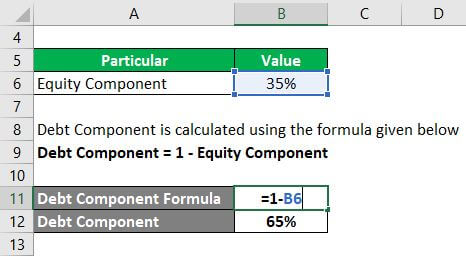

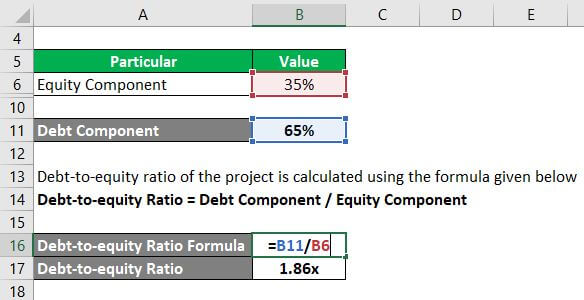

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

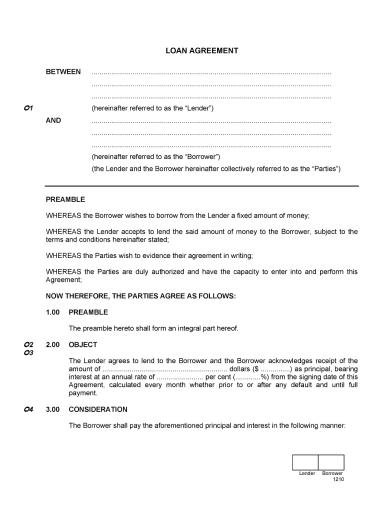

10 Agreement Between Two Parties For Money Examples Format Sample Examples

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Design Leaflet For Golden Eggs Home Loans Postcard Flyer Or Print Contest Sponsored Design Postcard Flyer Winning Flyer Leaflet Custom Postcards

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Capital Structure Complete Guide On Capital Structure With Examples

Effective Annual Rate Formula Calculator Examples Excel Template

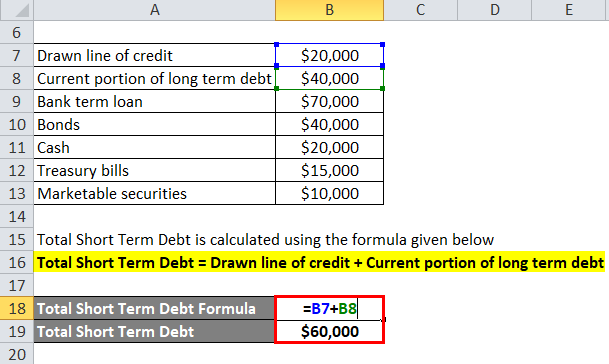

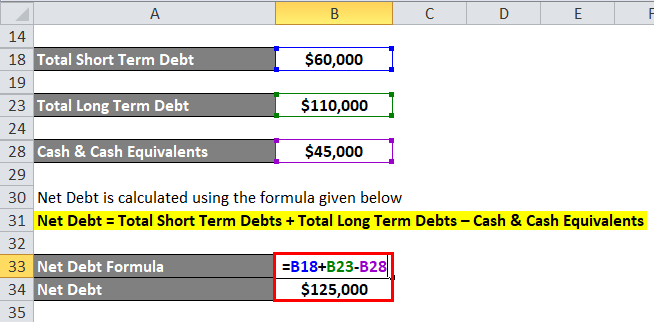

Net Debt Formula Calculator With Excel Template

18 Borrowing Capacity Halinalleyton

Effective Interest Rate Formula Calculator With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

Net Debt Formula Calculator With Excel Template

2

Net Debt Formula Calculator With Excel Template